what we are analyzing today is a high-precision mean reversion strategy designed specifically for binary options. This approach, often utilized by top traders, operates on the fundamental economic principle of market elasticity. The core concept here is that price action behaves like a rubber band; when it is stretched too far in a short period, it inevitably snaps back. We are not looking to predict the trend for the next hour; we are looking to capitalize on the immediate, inevitable reaction to price exhaustion.

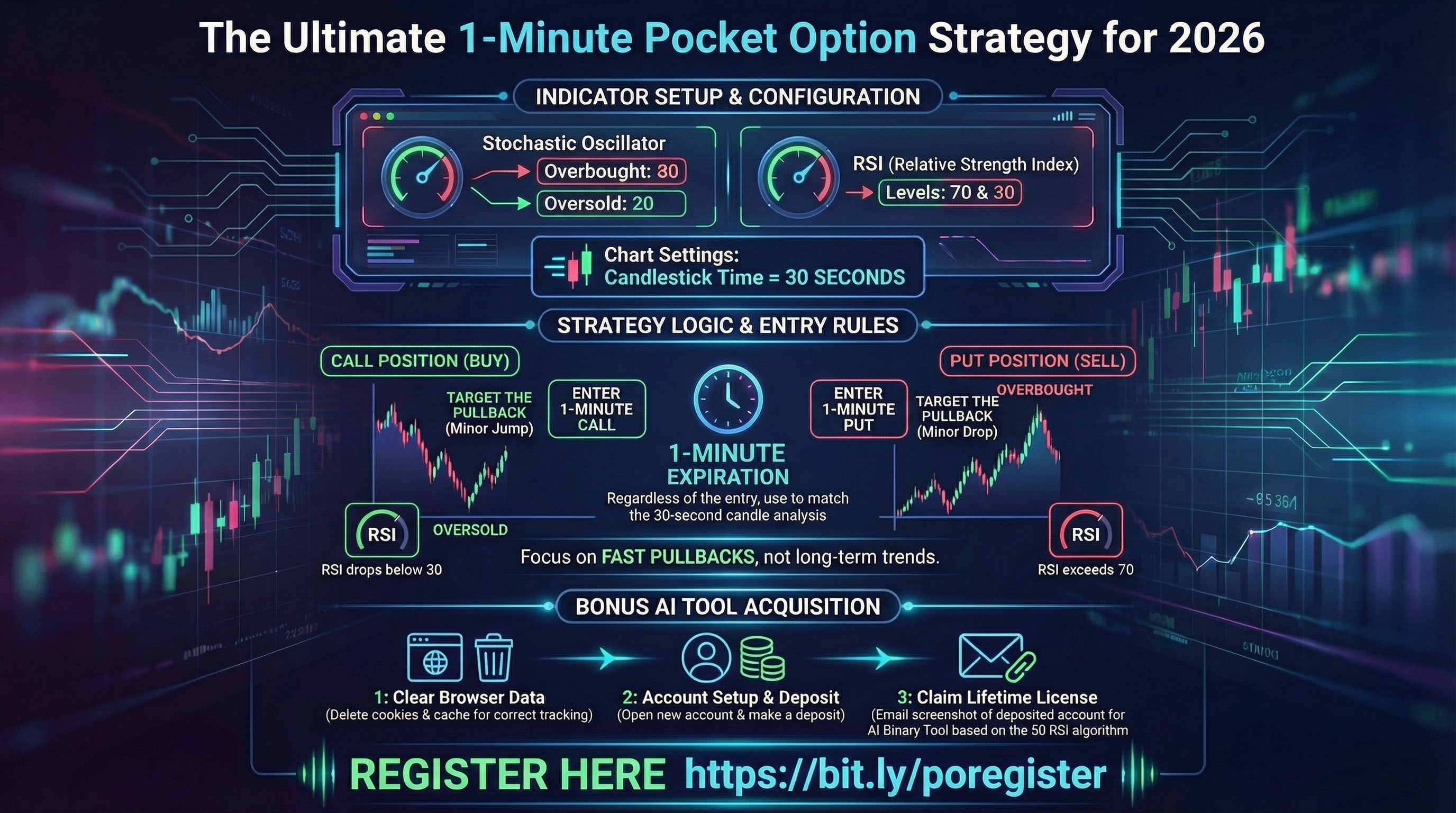

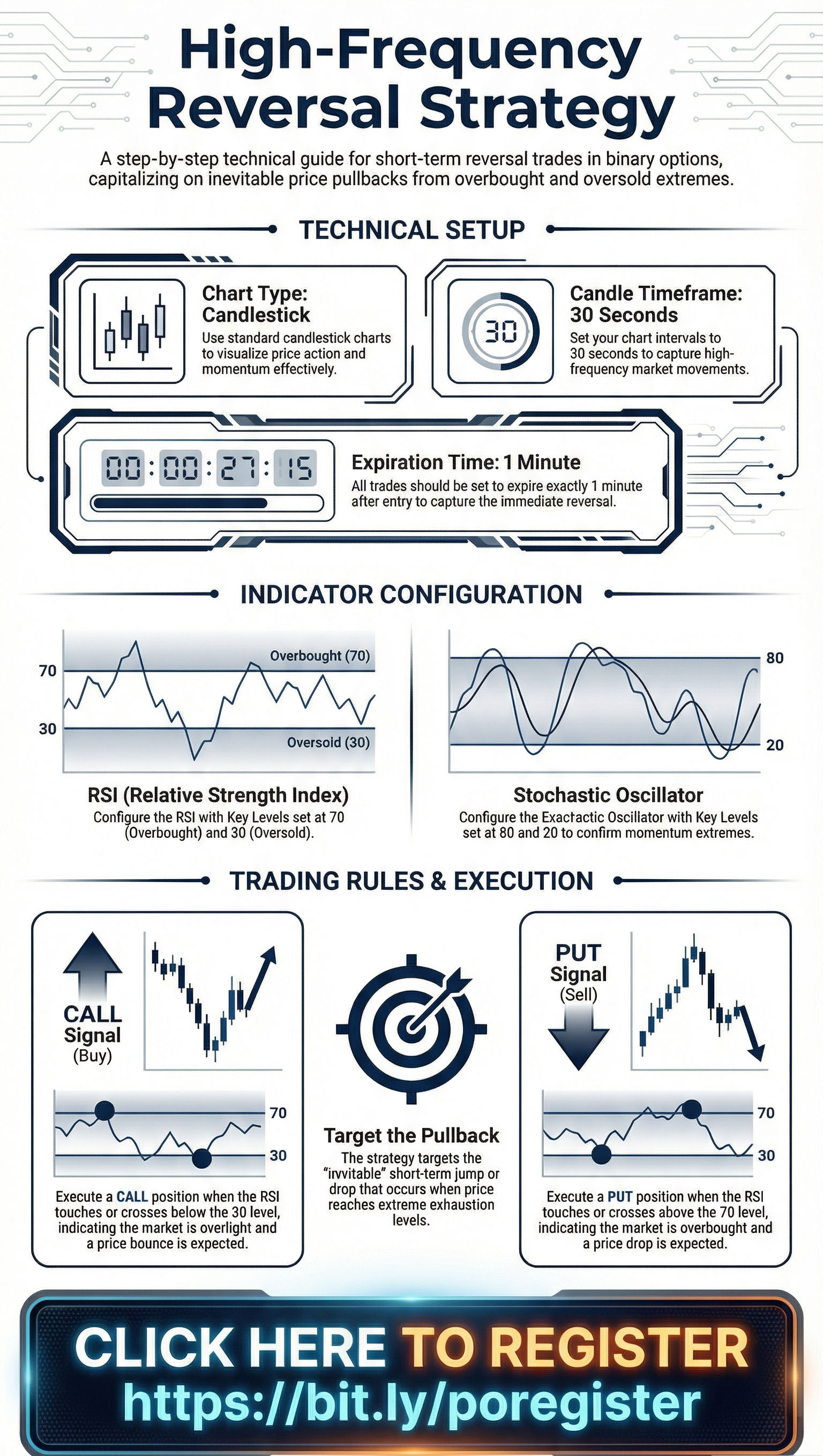

Let’s begin with the technical architecture of our chart, as displayed in the first visual. To execute this strategy effectively, we must operate in a high-frequency environment. We set our chart timeframe to 30-second candlesticks. This specific timeframe is crucial because it allows us to see the granular volatility that longer timeframes hide. Paired with this, our trade expiration time is set strictly to one minute. This 2:1 ratio between expiration and candle time gives the market exactly enough time to produce the 'pullback' reaction we are targeting.

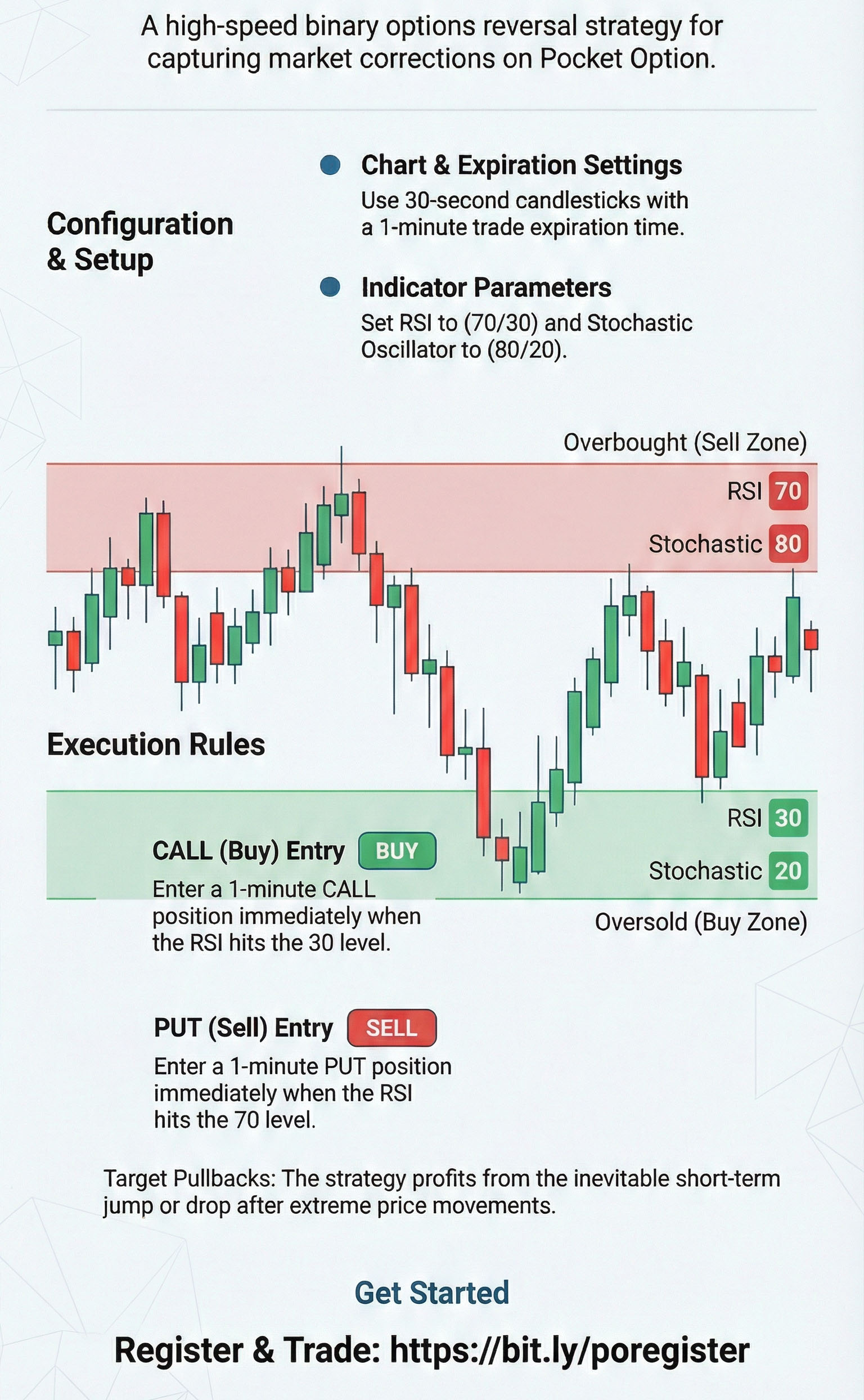

Now, looking at our indicators, we strip away the noise and focus on momentum oscillators. The primary driver of this strategy is the Relative Strength Index, or RSI. We have configured the RSI with key levels at 70 and 30. The 70 level represents the ceiling—the zone of 'Overbought' conditions where buyer exhaustion occurs. Conversely, the 30 level represents the floor—the 'Oversold' zone where sellers are losing momentum. This indicator serves as our primary signal for entry.

Ready to test this on a Live/Demo account?

Register & Trade Now

To filter out false signals, we incorporate a secondary confirmation tool: the Stochastic Oscillator. While the RSI tracks the speed of price change, the Stochastic helps us identify the momentum relative to the high-low range. We utilize the levels of 80 and 20 for this oscillator. When both the RSI and the Stochastic align in these extreme zones, the probability of a reversal increases exponentially, providing us with a high-confidence setup.

Let’s discuss the psychology behind the 'Call' or Buy setup. As you can see in the bullish scenario on the infographic, we patiently wait for the market to dive. We are looking for the moment the RSI line hits or breaks below the 30 level. At this precise moment, the asset is mathematically oversold. The selling pressure is unsustainable in the short term, and the market must breathe. This is our trigger to enter a Call trade for one minute, anticipating that immediate upward correction.

Conversely, for the 'Put' or Sell setup, we look for irrational exuberance in the price. When the candles surge upward and the RSI line hits or pierces the 70 level, we know the asset is overbought. The 'rubber band' is stretched to its limit. At this peak, the buyers are exhausted, and a drop is imminent. We do not wait for a long trend reversal; we strike immediately with a Put trade for one minute to capture the initial drop.

It is important to understand that this strategy is purely reactive, not predictive. We are not guessing where the price will go; we are reacting to where the price is. The beauty of this approach lies in its discipline. If the RSI does not touch the 30 or 70 lines, we do not trade. We remain on the sidelines like a sniper waiting for the perfect alignment. This patience is what separates profitable traders from gamblers.

Furthermore, risk management in this strategy is built into the time expiration. By using a fixed one-minute expiration on 30-second candles, we avoid the trap of holding positions during long-term consolidations. We enter during high volatility, capture the reaction, and exit. This rapid turnover allows for multiple opportunities within a single trading session, compounding small wins into significant daily targets.

In summary, the efficiency of this strategy for 2026 and beyond lies in its simplicity and reliance on unchangeable market mechanics. Markets will always overreact to news and volume spikes, and they will always correct back to the mean. By mastering the RSI 70/30 and Stochastic 80/20 levels on a 30-second timeframe, you are equipping yourself with a mathematical edge over the house.

To implement this strategy effectively, you need a broker that offers precise execution and the specific indicators we discussed. For those ready to start applying this method, you can register for a reliable trading account using the official link displayed here: https://bit.ly/poregister

Start Your Trading Journey

Join thousands of successful traders using our high-frequency approach.

REGISTER FOR LIFETIME ACCESShttps://bit.ly/poregister